Capital Gains Tax: Everything You Need to Know

What is Capital Gains Tax?

Capital Gains Tax (CGT) is a tax on the profit you make when you sell or dispose of an asset that's increased in value. It's the gain you make that's taxed, not the amount of money you receive.

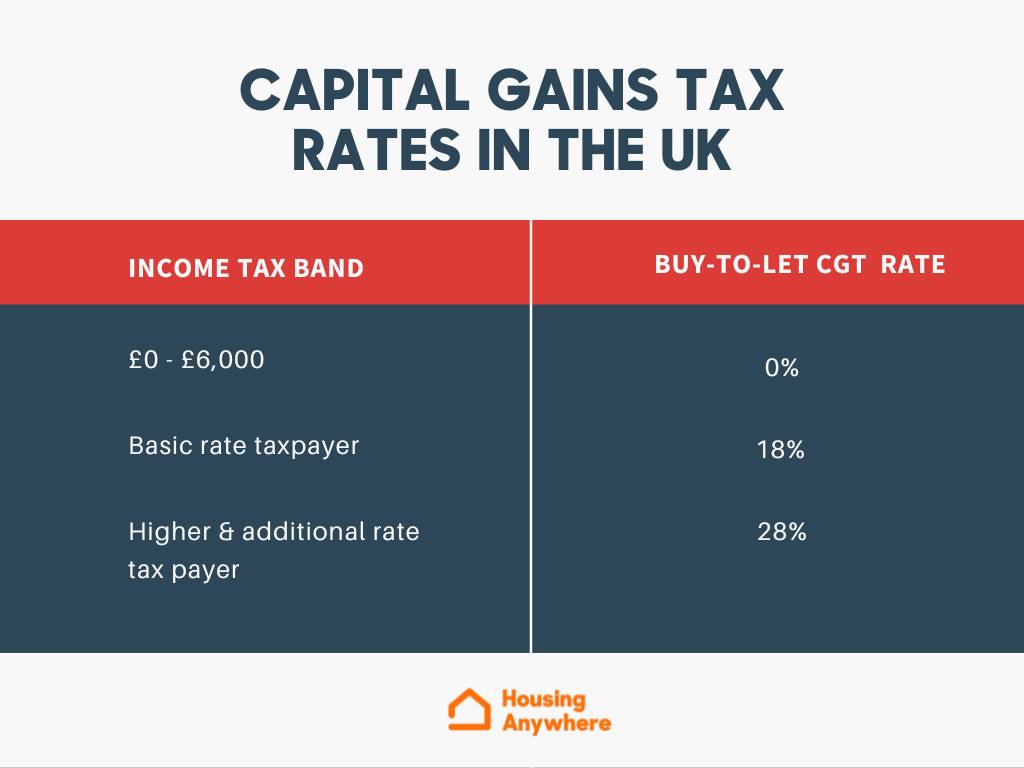

Rates for Capital Gains Tax

The CGT rate you use depends on the total amount of your taxable income. The current rates are:

- 10% for basic-rate taxpayers

- 20% for higher-rate taxpayers

Capital Gains Tax Allowance

The capital gains tax allowance in 2024-25 is £3,000, which is half of what it was in 2023-23. This is the amount of profit you can make from an asset this tax year before any tax is due.

This change means that more people are likely to pay CGT, so it's important to be aware of the rules and how they might affect you.

Tax treatment depends on your individual circumstances and may be subject to future change.

Comments